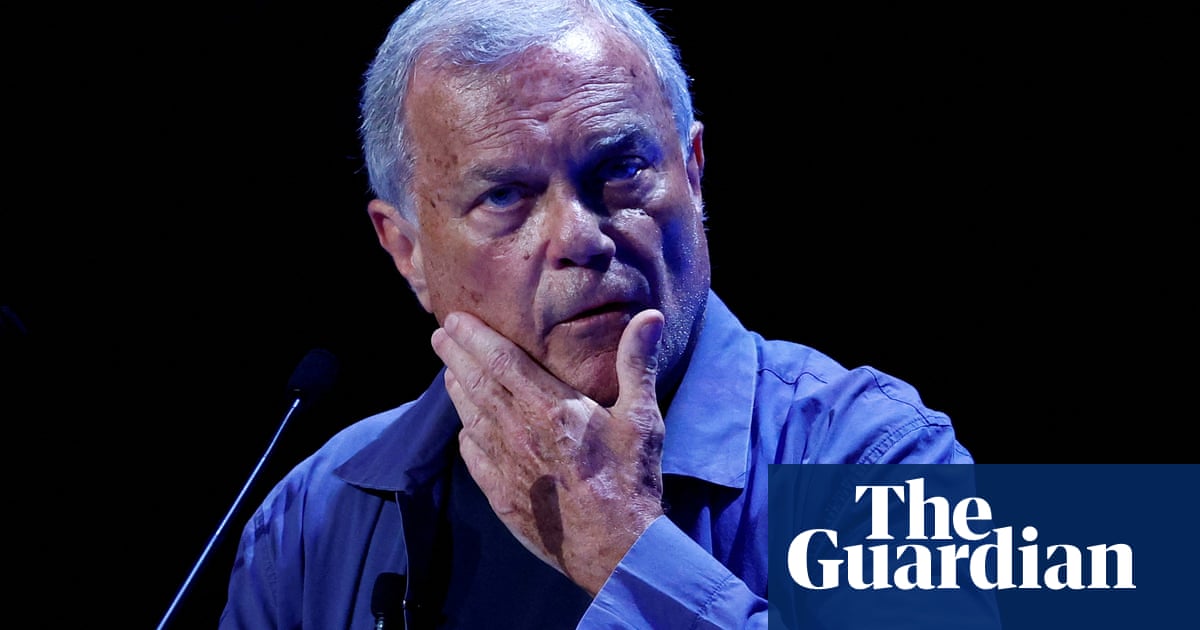

Sir Martin Sorrell’s S4 Capital lost nearly half its stock market value after issuing a warning that the cost of the rapid hiring of staff has outstripped profit and revenue growth.

The share price of S4 Capital, Sorrell’s fast-growing digital advertising comeback, formed after his acrimonious departure from WPP four years ago, has slumped by 80% in the last year.

On Thursday, the company’s market value fell 46% from £1.26bn to £700m after issuing a profit warning that slashed full-year earnings.

It cut its estimate for full-year core earnings to about £120m from a market expectation of approximately £160m after rapid hiring in the content division hit first-half earnings.

Sorrell, who built WPP into the world’s biggest advertising holding company before resigning in 2018 over allegations of personal misconduct that he denies, is enduring a torrid year compared with his former employer, whose shares have fallen by 9% over the last 12 months.

In May, Sorrell pledged to restore investor confidence after describing the twice-delayed reporting of S4 Capital’s annual results as “unacceptable and embarrassing”. The delayed publication of the results – after the auditor, PwC, said it was “unable to complete the work necessary” – wiped almost $1bn (£810m) off S4’s market value.

The slump in S4’s share price will have cost Sorrell, who is the company’s biggest individual shareholder with about a 10% stake, more than £50m.

Sorrell had argued that S4 – able to analyse data quickly and place targeted ads online – would grow rapidly because it operated only in the faster-growing digital sector and was not held back like legacy agencies that were designed for an era of traditional TV advertising campaigns.

However, the slump in share price is dramatically affecting Sorrell’s ability to continue the fast-paced deal-making that has been a hallmark of his strategy. Many of the deals have been made offering a split of cash and shares in S4, and with a tumbling share price that become more difficult.

Jessica Pok, an analyst at Peel Hunt, said: “This is disappointing, given that market expectations on margins have been pulled back several times since last year. The silver lining is that client demand continues to be strong. S4 has suffered a series of control and accounting issues. While the shares are cheap, even post the downgrade, it may take time to regain investor support.”

Analysts at Citi described the “fairly significant” downgrade as “growing pains” showing that, for all Sorrell’s claims that S4 Capital represents a different business model, it is in effect a traditional advertising agency.

S4 maintained its target for 25% like-for-like gross profit after meeting first-half expectations.