US economic growth slowed sharply in the first quarter of the year, despite strong consumer spending resilient to interest-rate rises designed to tame historic inflation.

The latest GDP figures released by the US commerce department show that the world’s largest economy slowed sharply from January through March, to just a 1.1% annual pace as businesses reduced inventories amid a decline in housing investment.

The abrupt deceleration from 2.6% growth in the final three months of 2022 and 3.2% from July to September came in significantly under economists’ expectations of a 2% increase.

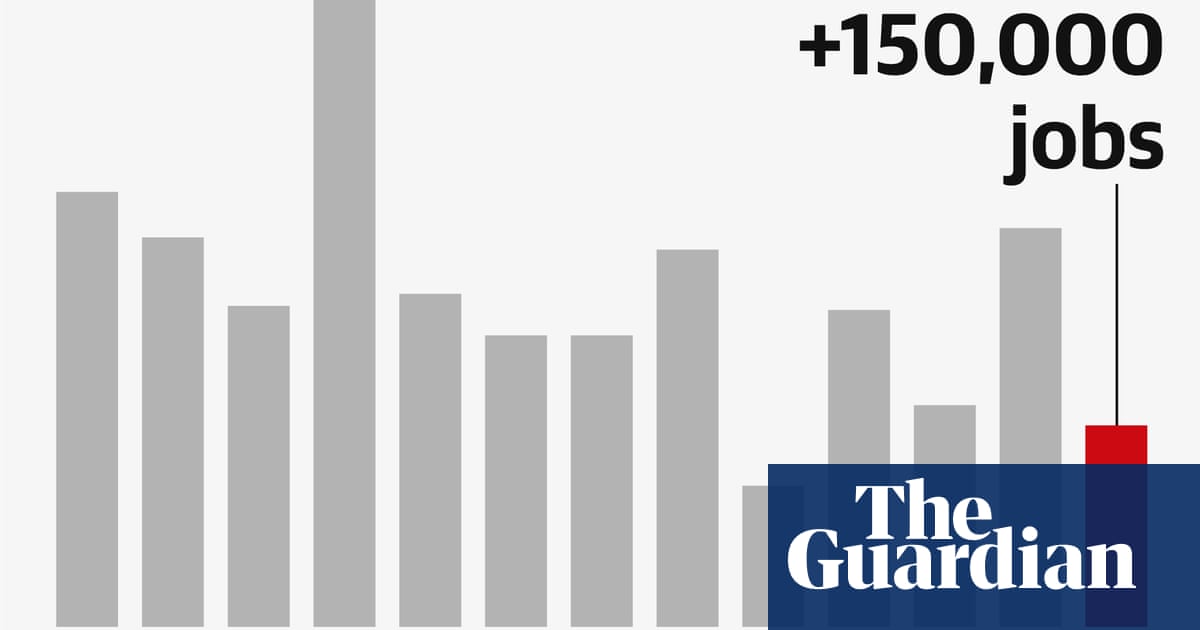

The figures indicate that aggressive interest rises designed to tame inflation are beginning to produce what US central bankers desired – a slowing economy coupled with reduced wage increases and a tighter job market without tipping it into outright recession.

“The data confirm the message from other indicators that while economic growth is slowing, it isn’t yet collapsing,” said Andrew Hunter, chief US economist at Capital Economics. “Nevertheless, with most leading indicators of recession still flashing red and the drag from tighter credit conditions still to feed through, we expect a more marked weakening soon.”

Resiliency in consumer spending, which rose 3.7%, reflected gains in goods and services and came as business investment in equipment recorded the biggest drop since the start of the pandemic in 2020 and inventories dropped the most in two years.

The Federal Reserve has indicated that while it has slowed the rate of interest rises, it expects commercial lenders, buffeted by the collapse of two regional banks this year, to tighten lending standards.

Many economists say the cumulative impact of Fed rate hikes and tighter lending requirements have yet to work their way through the system, presenting central bankers with a dilemma over whether to continue raising rates.

“The last thing the Federal Reserve wants to be doing is raising rates as the economy begins to grind to a halt and potentially exacerbating the situation,” said Marcus Brookes, chief investment officer at Quilter Investors.

“The coveted soft landing is looking increasingly difficult to achieve and we are now getting towards a position where the market may become concerned that stagflation could be a likely possibility.”

There is widespread skepticism that the Fed will succeed in averting a recession. An economic model used by the Conference Board, a business research group, puts the probability of a US recession over the next year at 99%.

That expectation is compounded by political risk, given congressional Republicans could let the US default on its debts by refusing to raise the statutory limit on what it can borrow. Wider global economic conditions are also in play.

Earlier this month, the International Monetary Fund downgraded its forecast for worldwide economic growth, citing rising interest rates around the world, financial uncertainty and chronic inflation.

The IMF chief, Kristalina Georgieva, said global growth would remain about 3% over the next five years: its lowest such forecast since 1990.